California teacher retirement calculator

To use this calculator youll need to get a copy of your earnings history from the SSA. With skyrocketing revenue and mouth-watering profitability NFL teams are now worth 447 billion on average.

California Teacherpensions Org

A childhood curiosity about the world fueled by National Geographic set Nathan Lump on a path to becoming the magazines 11th leader since its founding in 1888.

. The downsides of living in LA. Copy and paste this code into your website. This includes California teachers who are in CalSTRS.

Account for interest rates and break down payments in an easy to use amortization schedule. Teacher Loan Forgiveness Program. We provide leadership in recruiting training and retaining highly talented employees and cultivating a workplace where employees can thrive.

However the earnings portion of a non-qualified distribution will usually be subject to ordinary income tax and a 10 tax penalty though there are. This lets us find the most appropriate writer for any type of assignment. Calculations are estimates only.

If you return to CalSTRS-covered employment or if you are a member of another California public retirement system you may. Fed hikes interest rates for fourth time this year A higher-than-expected consumer price inflation report for June compelled the Fed to maintain its brist pace of policiy tightening by raising interest rates another 075 Read more of the latest insights from Brian Nick Chief Investment Strategist. Upon retirement he began receiving his California teachers retirement pension of 3000 per month.

She married a Spaniard had children and in 2000 moved to the Costa del Sol. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. This calculator is provided as a retirement planning tool to help you estimate your future retirement benefit. As the area is more economically diverse and less dependent on high-tech industry than northern California the economy continues to be relatively strong for California.

California Sales Tax. Your household income location filing status and number of personal exemptions. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more.

These articles are verifiable valuable contributions to the encyclopedia but are a bit odd whimsical or something one would not expect to find in Encyclopædia BritannicaWe should take special care to meet the highest standards of an. Public health nurses may travel to community centers schools and other sites. Californias Overall Tax Picture.

All imaginable serviceshigher education healthcare transportationare available in abundance. Best Savings Account Rates. Due to Adobes decision to stop supporting and updating Flash in 2020 browsers such as Chrome Safari Edge Internet Explorer and Firefox will discontinue support for Flash-based content.

Use our free mortgage calculator to estimate your monthly mortgage payments. Barbara Friedberg is an author teacher and expert in personal finance specifically investing. Contributions to 529 plans can be withdrawn at any time.

The GPO and WEP cut or eliminate earned Social Security retirement benefits. The minimum sales tax in California is 725. So long gone are the days when they were paid.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. His wife retired at the same time and filed for her Social. Canadian expat Aprile Winterstein has lived in Rincón de la Victoria for 20 years out of the 30 that she has been in Spain.

Many of these retirees have earned Social Security retirement benefits from other work during their lifetimes or for being an eligible spouse. For nearly two decades she worked as an investment portfolio manager and chief financial officer for a real estate holding company. WEP Windfall Elimination Provision.

Are caused by overcrowding and sprawl. For example a resident of California can choose to invest in a 529 plan in Vermont in order to attend a college in the state of New York. Get 247 customer support help when you place a homework help service order with us.

Of the over six million articles in the English Wikipedia there are some articles that Wikipedians have identified as being somewhat unusual. We support and encourage our employees success by offering a diverse environment and engaging experiences working with students faculty and staff. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

As a result this site has been retired. Lisa Murkowski has won the backing of several billionaire donors in her. The true state sales tax in California is 6.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. California is generally considered to be a high-tax state and the numbers bear that out. In California servers make right under 14 an hour in restaurants with fewer than 25 employees and 15 an hour in restaurants with over 25 employees.

All in all youll pay a sales tax of at least 725 in California. Rate applies to employer retirement plans. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

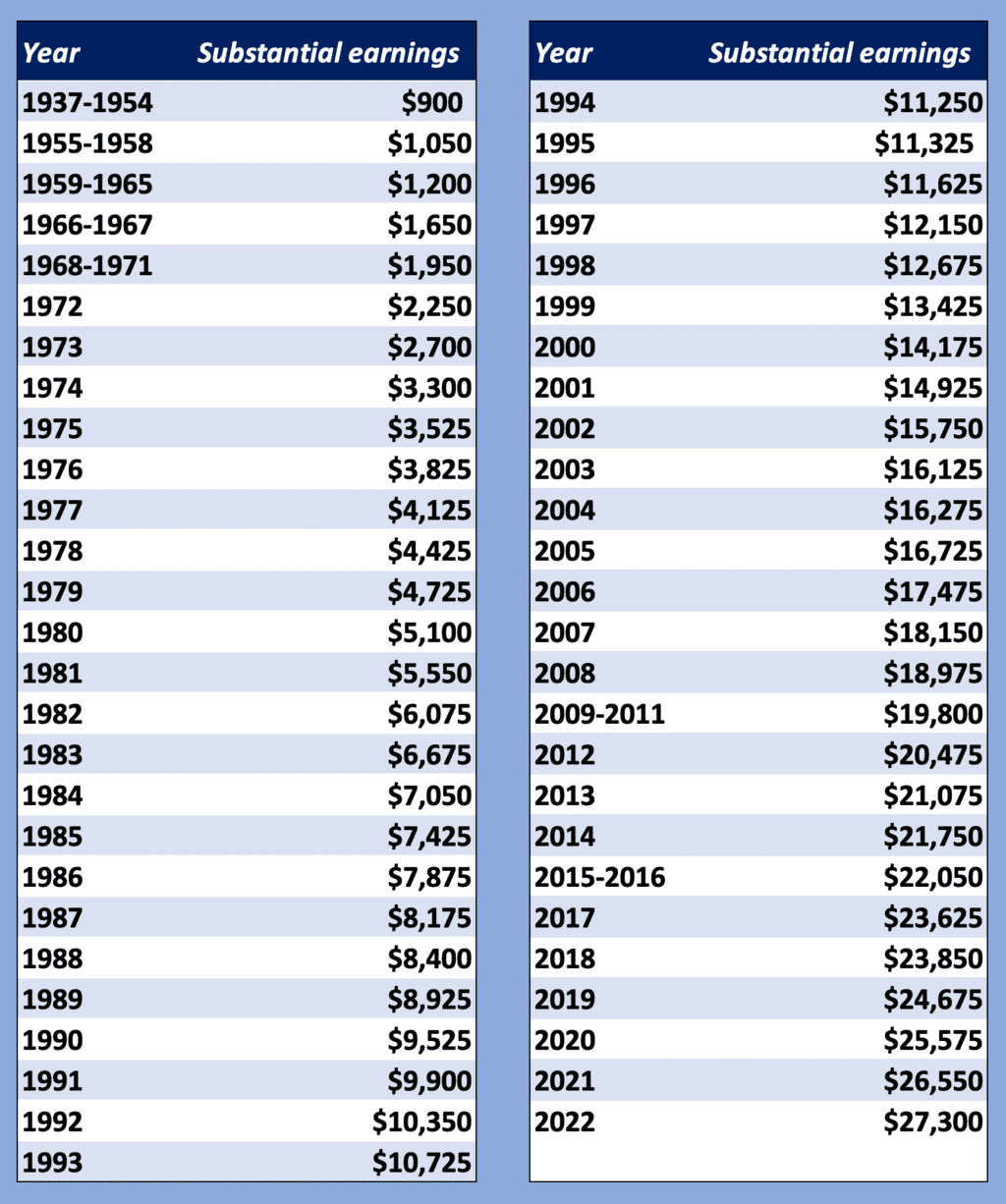

You should only put in your years of earnings that were covered by Social Security. Ambulatory healthcare services includes industries such as physicians offices home healthcare and outpatient care centers. She attended the University of Granada for a year when she was in college then stayed in Spain and worked as an English teacher.

Your household income location filing status and number of personal exemptions. Teachers who serve at least five years at a low-income school or educational service agency can apply for the federal Teacher Loan Forgiveness program. The Golden State also has a sales tax of 725 the highest in the country.

Nurses who work in home health travel to patients homes. This tax does not all go to the state though. The state then requires an additional sales tax of 125 to pay for county and city funds.

How Do You Calculate A Teacher Pension Teacherpensions Org

Understanding The Formula Calstrs 2 At 60 Youtube

Comparing Calstrs Pensions To Social Security Retirement Benefits

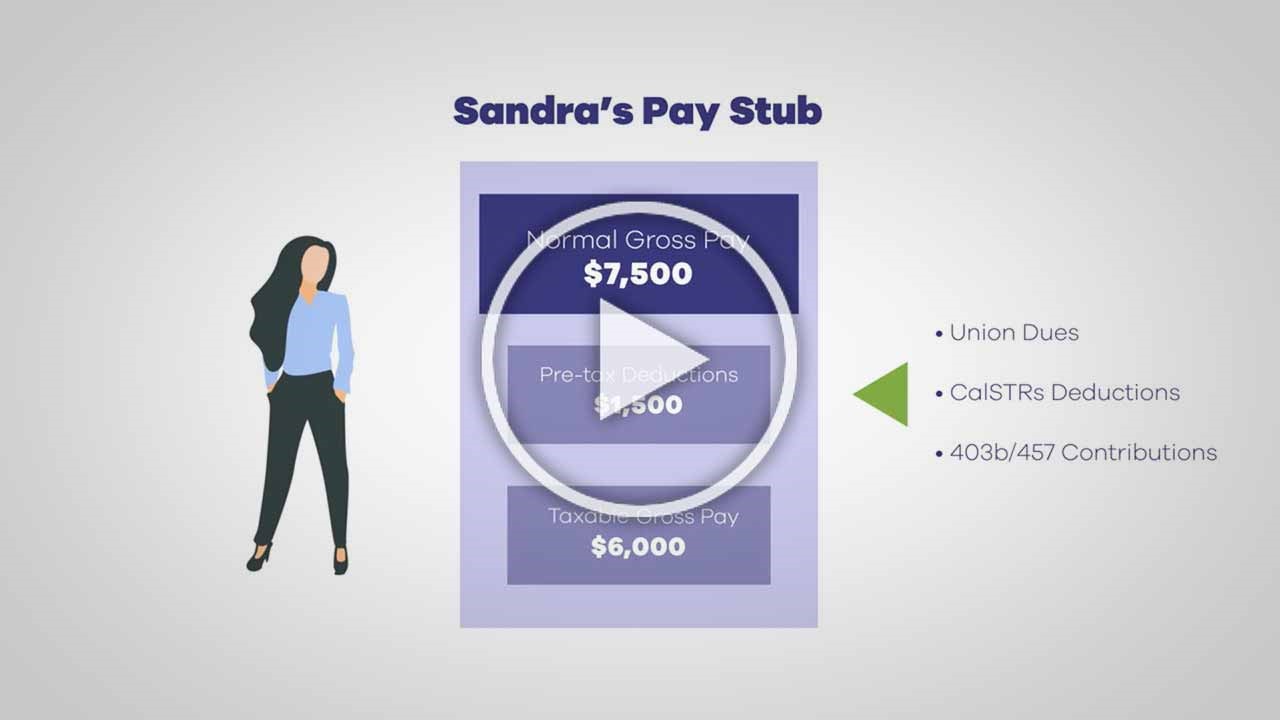

All About Your California Calstrs Pension A Teacher S Guide To Personal Finance

Calpro Network Calculate Your Calstrs Pension

Teacher S Retirement And Social Security Social Security Intelligence

2

Ny Teacher Pension Calculations Made Simple The Legend Group

Are Annual Contributions Into Calstrs Adequate

Overview Of Calstrs

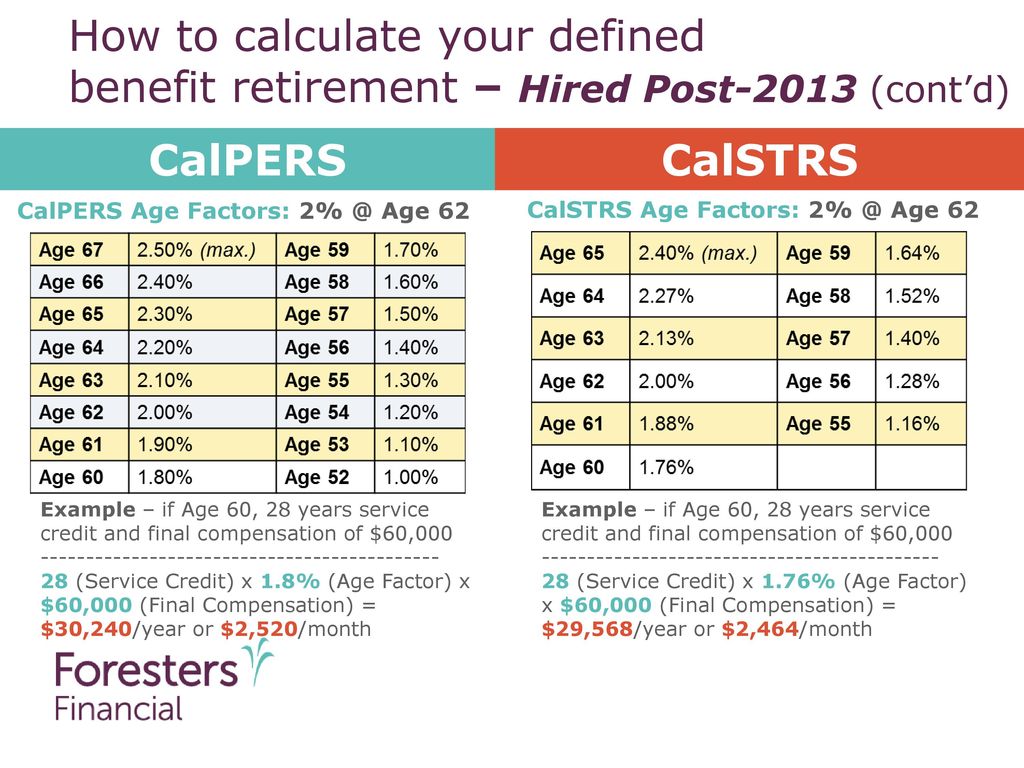

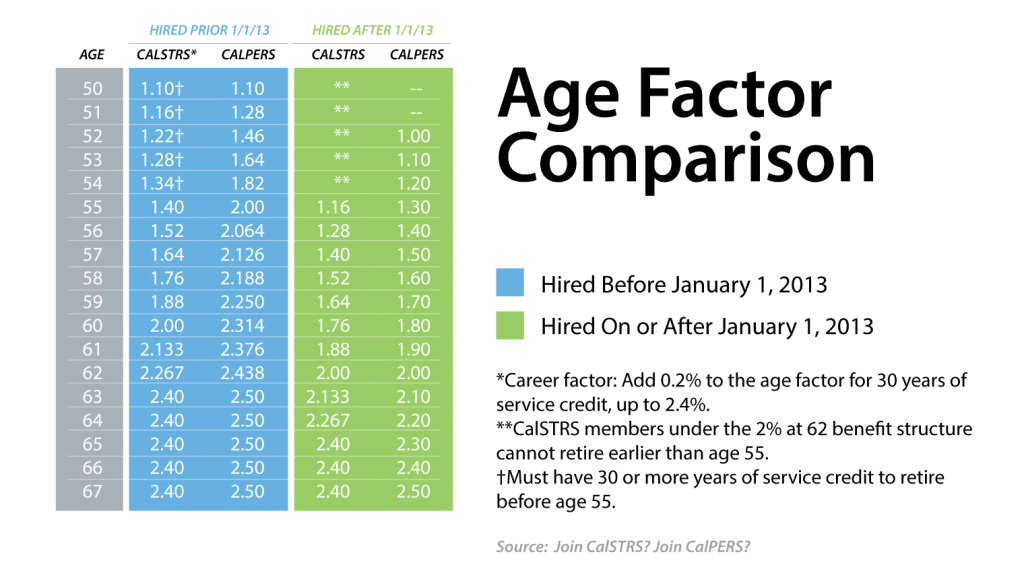

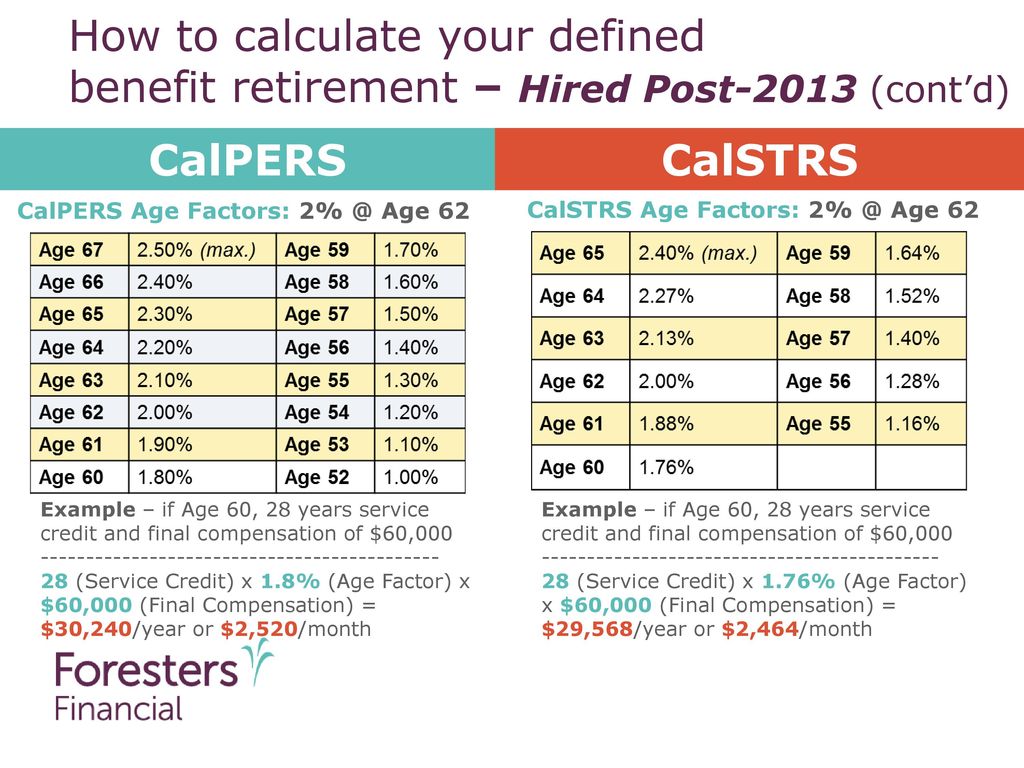

Planmember Calstrs And Calpers Retirement Benefits

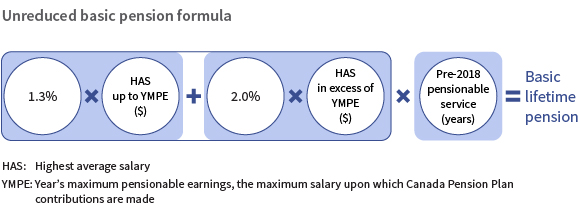

How We Calculate Your Pension Teachers Teachers

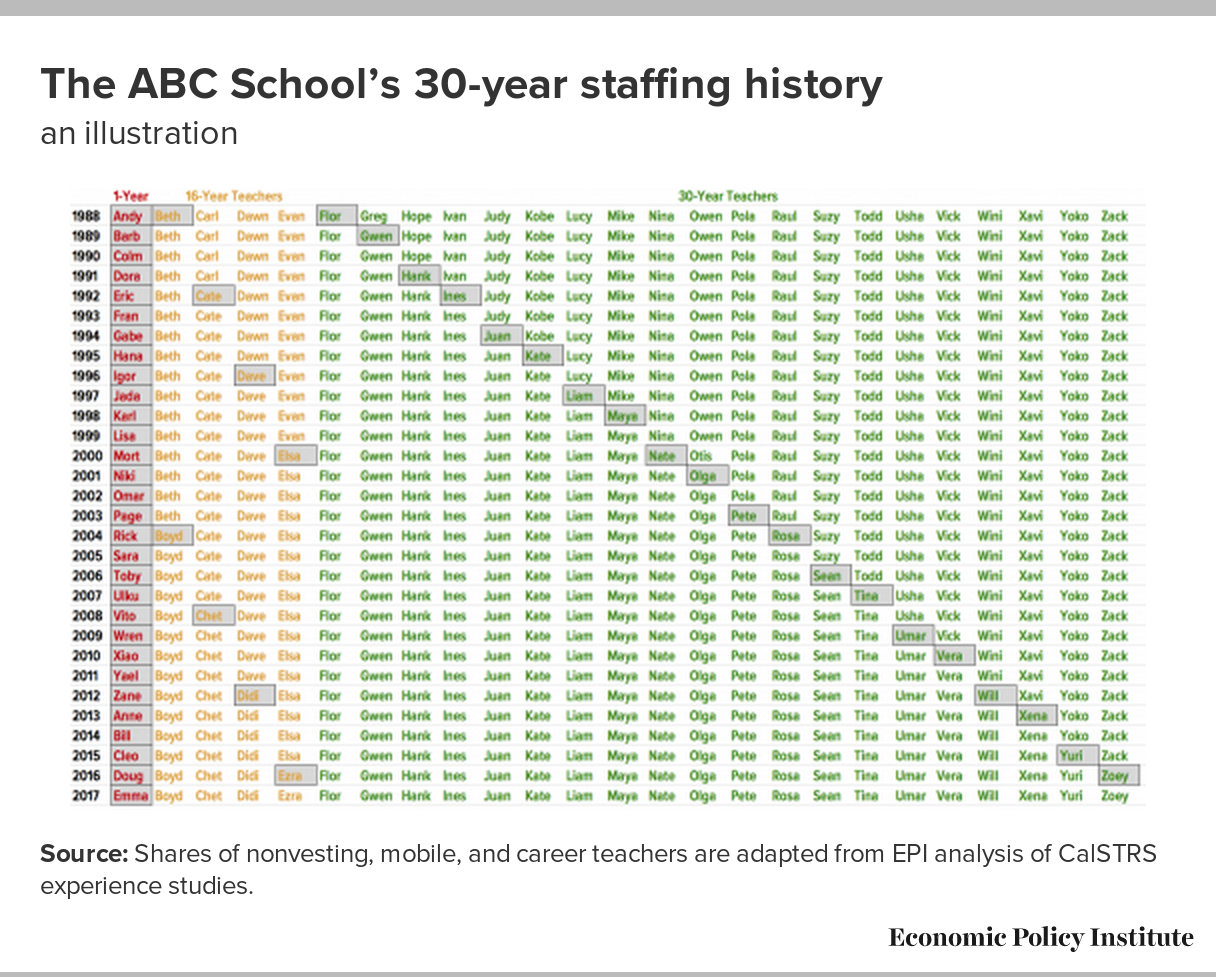

Teachers And Schools Are Well Served By Teacher Pensions Economic Policy Institute

2

Retirement Benefits Calculator Youtube

California Public California State Employees Teachers Ppt Download

/cloudfront-us-east-1.images.arcpublishing.com/pmn/VIA2VKIT7FDR5PYNW6HPOKD7GY.png)

How Psers Pension Fund Messed Up Its Performance Forcing Pa Teaches To Pay More